Role of Fintech in Shaping Mobile App Development in Canada

Fintech has been able to transform every vertical in the world and greatly influence mobile app development in Canada. With technology advancing so fast and people's preferences changing so fast, it only means one thing, that fintech is transforming the app development space and keeping innovation going while improving end-user experiences. This blog discusses the integral role that fintech plays in mobile app development in Canada.

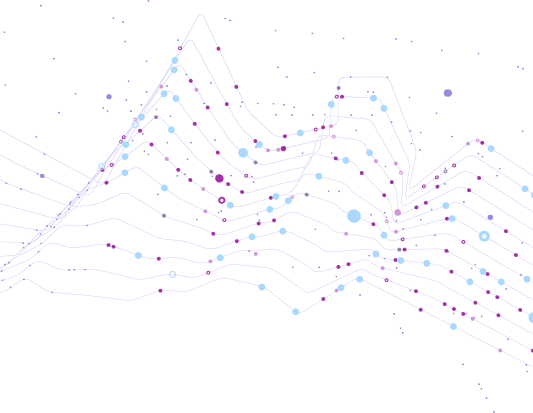

Fintech-Driven Innovation in Mobile App Development

Setting new standards in the application functions and performance capabilities is the hallmark quality of fintechs. By ensuring the marriage of futuristic yet contemporary technology such as AI, Blockchain, and Big Data analytics, fintech has really transformed the mold of user expectation from a modern mobile application. Now the modernized, popular-feeling applications of this era such as App-Ultimate combined a combination of artificial intelligence personalization for financial insights, secure transactions, user interface design with UI/UX concepts, are being accepted and habitual in the audience of every digital native country.

There is a paradigm shift with the introduction of the likes of Wealthsimple and Koho in Canada, both using AI to assist people in managing their finances for tracking expenditure or investing wisely or reaching financial goals. Such innovations have inspired wider mobile development, as they stimulate developers to embed similar user-centered features across verticals.

Improved Security Measures

Security is by far the major concern and is the primary requisite in mobile app development, particularly in applications like fintech that handle highly sensitive financial data. Canadian developers are also taking advantage of fintech innovations and adopting biometric authentication, end-to-end encryption, and real-time fraud detection systems.

The present application of blockchain technology to fintech has made data integrity and transparency deeper among factors that will meet consumer trust. Such benchmark-set advancements in the secure app development field force developers in other industry faces to develop at such standards.

The Impact of Open Banking on App Development

Open banking is another of those fintech trends changing the face of developing apps for mobile users in Canada. Open Banking gives access to secure APIs for third parties to be able to develop their apps using the financial data from other institutions. Meanwhile, such institutions focus on innovation and competition. This allows the development of specific applications that provide common financial views to users, enabling better decision-making.

For instance: an app which links all the accounts from various banks thereby allows all accounts for Canadian users to be managed at one platform through a unit of mobile applications. User experience is enhanced, and at the same time, it motivates automatic cross-industry app developers to think beyond a single application around APIs integration for better functionality.

Emergence of Digital Wallets and Contactless Payments

Fintech has also made a significant input into the use of digital wallets and contactless payment systems even in Canada. Google Pay and Apple Pay, together with the mobile wallet of Canadian Tire Bank, students now perceive the transaction from a different perspective when they mark as completed their online transactions. Payments can be done easily, securely, and more conveniently within this fast-paced and cashless economy.

The success of these innovations has very much influenced the areas of applications from e-commerce to transport into integrating payment gateways and digital wallets in their coming up transaction eco-systems.

Personalization Through Data Analytics

The mega-data analytics powerhouse that is Fintech applications uses information about the customer to build a customized and specialized financial feature that works just for that customer. Through its user agent's savings patterns, investment preferences, and credit profile, the app generates personalized recommendations that only make sense to that user's circumstance. This is indeed a new standard for creating mobile apps experience.

They are doing just that, and Canadian businesses across all industries are adopting such a data-driven culture. Personalized product recommendations on retail apps and examples of other similar types, such as fitness app workouts tailored for each consumer type, tell how far-reaching the example of fintech data-centric strategies is.

New Doors of Collaboration between Fintech and App Development

Fintech has opened wide doors for new avenues of collaboration between the mobile application developers and the growing technology. Given this, fintech companies are working with app developers to innovate solutions tailored for the Canadian market. They ensure that nothing but the best style in technology will be made available in applications for this territory.

For example, applications have been developed in collaboration to give financial literacy tools along with microloans to underserved communities. These efforts would instigate the process of inclusive finance and serve as a model to show what might be achieved through the combination of fintech and app creation.

Challenges and Future Prospects

On one hand, fintech brings several strides to the development of mobile applications, while on the other hand, it raises challenges for professional developers. Some of the difficulties include regulation, privacy of data, and a constant upgrading of technology. While these obstacles can only spur innovation, they push many companies to meet tough standards while delivering impeccable user experience.

In the future, new technologies such as quantum computing, decentralized finance (DeFi), and Internet of Things (IoT) will be the basis for developing mobile apps in Canada into fintech apps. Businesses that adopt these innovations will be winning competitors in the market.

Conclusion

Indeed, fintech has played a huge role in mobile application development in Canada. Innovation, security, and user-centered design are core components of app development, which can easily be manifested by fintech. Even as technology grows, so will the inputs from fintech specialists along with app developers to make innovative solutions to meet the changing demands of Canadians and Canadian businesses.