What started as the underlying infrastructure of cryptocurrency, mainly Bitcoin, became way more than this very foundational objective. The technology is now at the brink to make inroads into many a sector, be it finance, supply chain management, healthcare, or even mobile app development. In Canada, digital transactions are picking up speed, and the role of blockchain technology in ensuring the security of transactions via mobile apps is turning vital.

Understanding Blockchain Technology

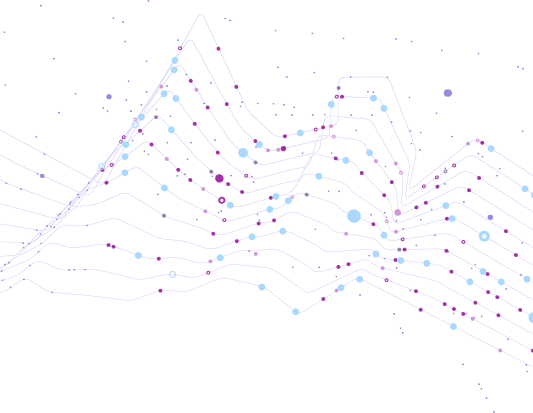

At the very basic level, it is a decentralized, distributed ledger that keeps a record of transactions across different computers. This inherent decentralization ensures that no single entity has power over the system, thereby rendering it impervious to fraud and tampering. Each transaction, otherwise known as a block, has an interrelation with its predecessors by a chain of records that are close to being immutable. It is this very property that really makes a blockchain apt for securing digital transactions.

The Growing Need for Secure Transactions

As mobile app usage grows in Canada, so grows the need for secure transactions. Canadians are increasingly using mobile apps for a myriad of activities such as banking, shopping, and even access to health services. The convenience this brings comes along with increasing risks of cyber attacks through hacking, data breaches, and identity theft. Traditional means against these include encryption and two-factor authentication, but these are usually inadequate in protecting sensitive information. This is where blockchain comes in.

How Blockchain Keeps Secure Transactions in a Mobile App

1. Decentralization and Transparency

One of the greatest things about blockchain is its decentralized nature. Blockchain transactions are verified by various nodes in the network, unlike traditional systems that depend on a central authority for validation. This makes it resistant to single-point failures, thus reducing risks of hacking and fraud. It also offers transparency in the sense that all transactions are recorded on a public ledger and accessible to all network participants. As a result, users tend to trust the blockchain due to this transparency and very few instances of fraud can be found as compared to traditional ways of doing things.

2. Immutable Records

Once a transaction is recorded on the blockchain, it can never be changed or removed. The immutability of this digital ledger makes the records of transactions tamper-proof, thereby adding an extra layer of security. In mobile applications, this would translate to the assurance that a user's transaction history cannot be modified. This can be very useful for financial apps where data integrity is paramount.

3. Smart Contracts

Blockchain also supports smart contracts, which are self-executing contracts between parties regarding transactions specified in code lines outlining conditions and terms of an agreement.

Smart contracts run a condition of enforceable terms. Therefore, there is no need for a third party, considering that the risk of each other is eliminated through the very nature of the smart contract. As an example, in transactions taking place in a mobile app, smart contracts could be used to take actions such as money transfer upon the happening of events previously defined. This, in turn, reduces the chances of human error and fraud, making transactions more secure.

4. High-level Security of Data

Blockchain's encryption methods are far superior to the ones used in traditional security systems. Each transaction is encrypted and connected to the previous one, thereby creating a chain of secured data.

It means in the case of mobile apps, this essentially means that user data, anchored to financial information, becomes pretty secure—thus, less hacking. Even if one block gets compromised, the remaining blocks in the chain are safe, thereby making it very tough for hackers to access the complete transaction history.

5. User Anonymity

Blockchain is transparent, it is also highly private. Most of the time, users on a blockchain network are identified only through a unique cryptographic address, not by their personal information. This anonymity not only protects the user identities but also further prevents cases of identity theft. Mobile app users in Canada can, therefore, transact with a lot of peace of mind, reassured that their personal information is safe. Real-World Use Cases in Canada.

Though it is in the nascent stage of adoption, blockchain technology is already used in Canadian mobile apps to support some industries.

1. Banking and Finance Sector

Interest in blockchain is thus increasing toward secure mobile transactions by Canadian banks and increasingly by financial institutions. For example, RBC has been testing blockchain technology to enhance transaction security and efficiency. Blockchain-imbued mobile banking apps can give several advantages in security to users, such as immutable records of transactions and smart contract-based payment.

2. E-commerce

Likewise, the e-commerce sector in Canada is realizing the benefits of blockchain. By implementing blockchain in mobile shopping apps, retailers will be in a position to assure customers of secure payment and the authenticity of products. Similarly, blockchain can assist in reducing chargeback fraud, so common in e-commerce, since indisputable proof of transaction history will be provided by blockchain.

3. Healthcare

In healthcare, blockchain may also be applied to secure patients' sensitive information when transacting through mobile health applications. Canadian healthcare providers are at the beginning of adopting blockchain technology to secure patient records, thus assuring that the medical histories are free from tampering. This is particularly pertinent with the growing number of Canadians who use mobile apps to manage their health and wellness.

The Future of Blockchain in Canadian Mobile App Transactions

As blockchain technology matures, this role in securing transactions made from Canadian mobile applications is expected to grow. The growing demand for digital secure and transparent transactions is likely to drive the penetration of blockchain technology in various industries. Moreover, when regulatory frameworks around blockchain are more defined, in all likelihood, Canadian businesses and consumers will experience more use of this technology in their transactions.

This is where blockchain provides an effective solution for secure in-app transactions within Canada. Being decentralized, transparent, and immutable, it makes for a near-perfect technology to secure sensitive data and ensure integrity in digital transactions. As more industries tilt toward this innovative technology within their mobile apps, Canadians can only look forward to a future where digital interaction becomes both easy and secure.